Past Due Invoice in Excel (Basic)

Free past due invoice template for you to print or download. It's in portrait layout and available in PDF, Word, and Excel format.

Use this past due invoice template to request payment from customers or clients who have missed payments for the original invoice. This document will help remind your client of the payment terms and due date of the invoice.

If your agreement with the client includes a late fee for any missed payments, this shall be included in the calculations for the new invoice.

The past due bill template is printable and downloadable in PDF, Word, and Excel format.

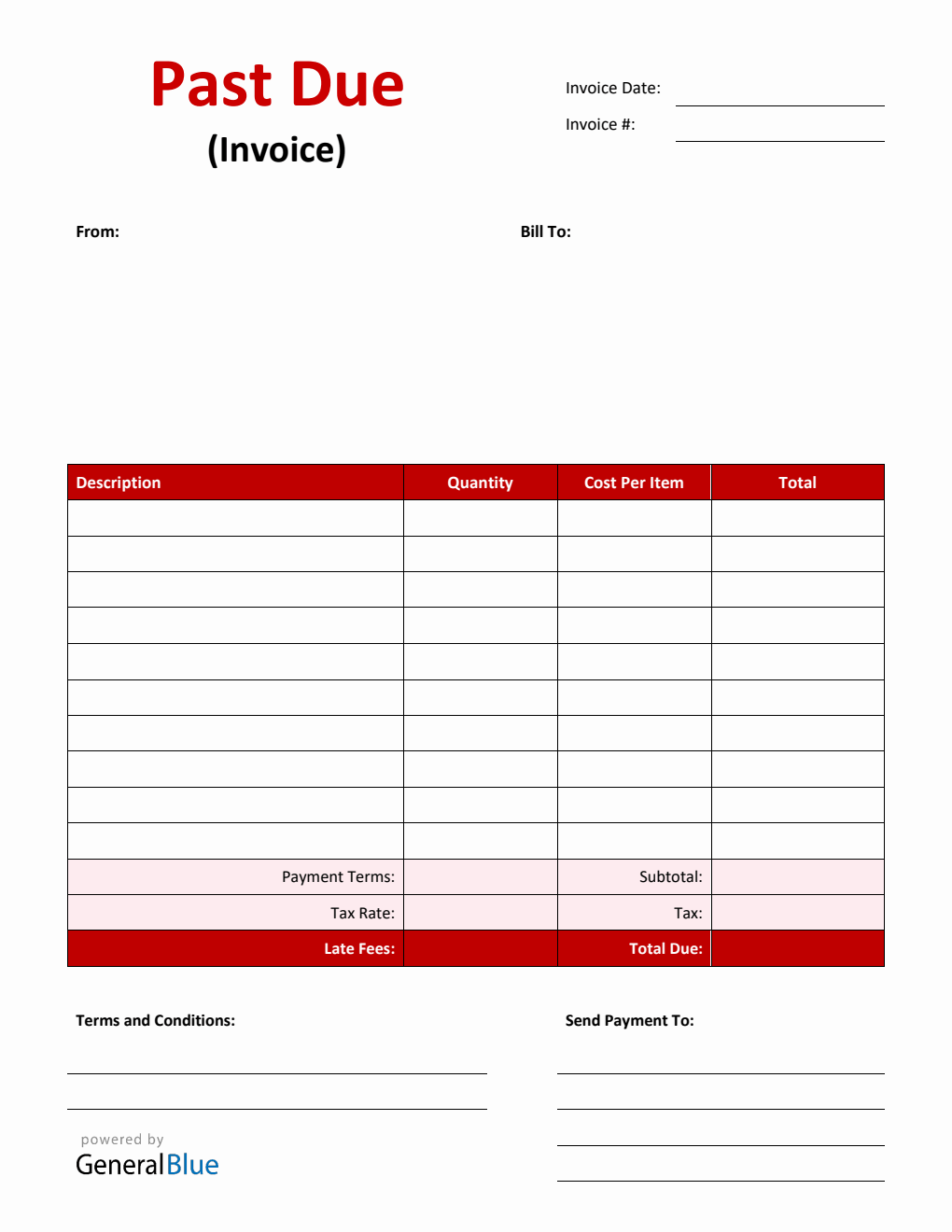

It has sections for the invoice date, invoice number, from and bill-to address, description, quantity, cost per item, subtotal, payment terms, tax rate, tax, late fee(s), total due, terms and conditions, and payment details.

Instructions:

Fill out the date and invoice number

This is indicated at the top section of the invoice template. Here, you need to indicate the date when the invoice is created as well as the invoice number for your client. The invoice number usually starts with 1 and increments over time. If you have a long-term contract with your client, it is an essential part of your invoice as it helps in tracking all invoices.

Enter your company information

Enter your company name and business address in this section. It includes the street address, city, state, zip code, and phone number.

Enter the bill-to information

Enter the billing address of the company or client whom you have sold the goods/services to. The bill-to information includes the name (or company name) of your client, their address, city, state, zip code, and phone number.

List all the goods/services sold to your client

Under the description column, list all the goods/services sold to your client.

Enter the quantity and cost per item

Each item sold should have a corresponding quantity and cost (per item) entered on the same row.

Enter the payment terms

Enter the agreed payment terms between you and your client. Most common payment terms are Net 30 or Net 15. Net 30 means your client has 30 days to complete the payment, and 15 days for Net 15.

Enter the tax rate and late fees (if applicable)

Enter the tax rate as well as any late fees (if applicable) based on your agreement with your client for any past due payments. For those looking for an invoice template that calculates automatically, we recommend downloading our excel past due invoice.

Add your terms and conditions (if applicable)

Add your payment details Some of the templates provided by General Blue includes section where you can indicate your mode for receiving online payments. Here you can indicate what your client or customer may need to complete payment processing.