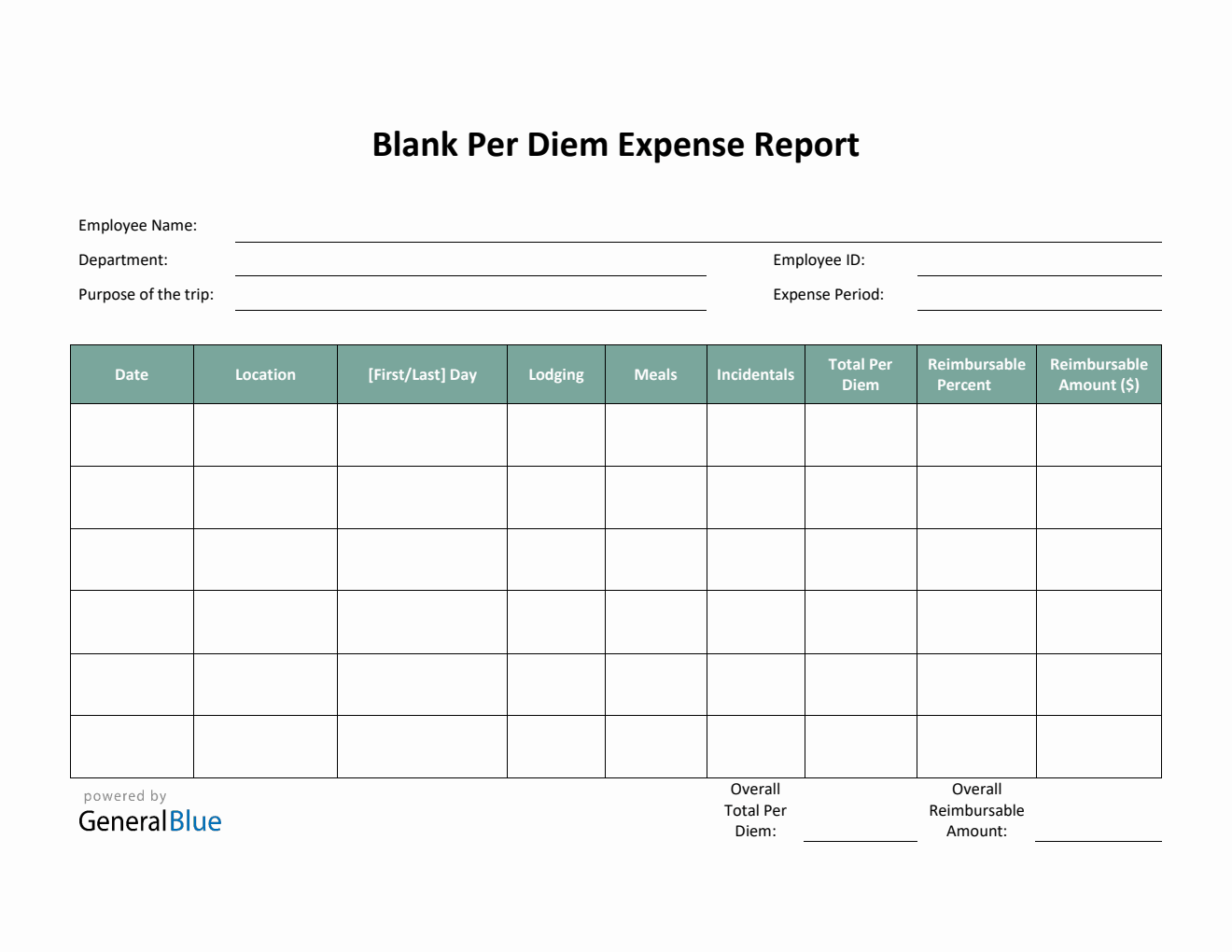

Blank Per Diem Expense Report Template in Excel (Green)

Get this free Blank Per Diem Expense Report Template available in Excel to help track your employees’ business travel expenses on a daily basis.

This per diem expense report example in Excel can be used by employees to record lodging, meals, and incidental expenses for each day of business travel.

Per diem rates may vary based on the travel destination. Some cities or states may have higher or lower expense rates depending on their locations.

Many privately owned businesses in the US generally use the General Services Administration as their guide for determining the travel allowances for their employees. However, as a public or privately owned business, how much you allow your employees to spend on business travels is entirely up to you.

As such, this editable expense report for per diem would be helpful for those who want to track their employees’ daily travel expenses.

The sample per diem expense report include sections for employee name, department, purpose of the trip, employee ID, expense period, date, location, first/last day of trip, lodging, meals, incidentals, total per diem, reimbursable percent,and reimbursable amount.

For those who prefer a template with formulas, it is recommended to download the per diem report in Excel.

Instructions:

Enter employee name, department, and employee ID.

Enter purpose of the trip along with the expense period.

Enter date of travel and corresponding location or travel destination.

Specify your first and last dates of travel. Under the 'First/Last Day' column, put "First Day" on the first date of your travel and "Last Day" on the last date of travel. The purpose for this is to calculate the total amount specific to the company's policies. Some companies allow a different percentage (e.g., 75%) for first and last day, while days in between are reimbursable at 100%. However, that percentage may vary per company.

Indicate the per diem rates for your lodging, meals, and incidental expenses. Enter your daily travel expenses on the designated sections.

Note: Incidental expenses may include tips and transportation costs for ground travel between hotels, airports, restaurants, etc.

Enter the reimbursable percentage for your expenses according to your company policies (e.g., 100% if expenses should be reimbursed in full, 75% if partial reimbursement only, or others). Some businesses may only allot partial travel allowances (75%) on employees first or last days of travel since some of those hours may have been spent at home or in the office.

Review, email, or print the completed expense report. Receipts of all expenses should be attached along with this expense report for documentation purposes.